inheritance tax rate kansas

The sales tax rate in Kansas for tax year 2015 was 615 percent. Your average tax rate is 1198 and your marginal tax rate is.

Assessing The Impact Of State Estate Taxes Revised 12 19 06

Not all states have an inheritance tax.

. Like most states Kansas has a. The surtaxes are generally uniform. In 2020 rates started at 10 percent while the lowest rate in 2021 is 108 percent.

The state sales tax rate is 65. Below are the ranges of inheritance tax rates for each state in 2021 and 2022. Kansas does not have an estate or inheritance tax.

Like most states kansas has a progressive income tax with tax rates ranging from 310 to 570. Kansas does not have an estate tax or. Whether or not Kansas has an inheritance or estate tax.

Here youll find clear and accurate information about how to inherit property including. Click the nifty map below to find the current rates. How probate works in Kansas.

In addition to the federal estate tax with a top rate of 40 percent some. Many cities and counties impose their own sales tax bring the overall rate to between 85 and 9. Also Kansas residents who inherit from Kansas estates or estates in other states need to understand inheritance tax because they may be responsible for paying an.

No city or township has a rate higher than 225 and 36 have a lower rate as low as. Kansas Income Tax Calculator 2021. A strong estate plan starts with life.

The ohio estate tax was repealed. Connecticuts estate tax will have a flat rate of 12 percent by 2023. Retirement income from a 401k pension or IRA is.

The size of the inheritance. If you make 70000 a year living in the region of Kansas USA you will be taxed 12078. The Michigan Inheritance Tax is still in effect even though the tax was eliminated in 1993.

The top estate tax rate is 12 percent and is capped at 15 million exemption threshold. Note that historical rates and tax laws may differ. As a result the Michigan Inheritance Tax is only applicable to people who inherited from a person.

County taxes is 075 and city and township taxes are 225. To find a financial advisor who serves your area try our free online matching tool. Hi does kansas have an inheritance tax.

As of 2012 only those estate assets in excess of 5120000 are subject to the federal estate tax which has a. In the tax year 202122 no inheritance tax is due on the first 325000 of an estate with 40 normally.

The Estate Tax And Real Estate Eye On Housing

Where Not To Die In 2022 The Greediest Death Tax States

Weekly Map Inheritance And Estate Tax Rates And Exemptions Tax Foundation

Kansas Inheritance Laws What You Should Know

Exploring The Estate Tax Part 1 Journal Of Accountancy

/Inheritance_Tax_Final-0c412b7f515f4d9aa7d7489b3f8b02fc.png)

Inheritance Tax What It Is How It S Calculated Who Pays It

Corporate Income Taxes Urban Institute

Expanded Tax Breaks For Kansas Seniors Will Harm Low Income Seniors And Other Kansans Kansas Action For Children

Asphalt City How Parking Ate An American Metropolis

Kansas Inheritance Laws What You Should Know

Does Your State Have An Estate Or Inheritance Tax Tax Foundation

Estate And Inheritance Taxes Around The World Tax Foundation

Estate Tax In The United States Wikipedia

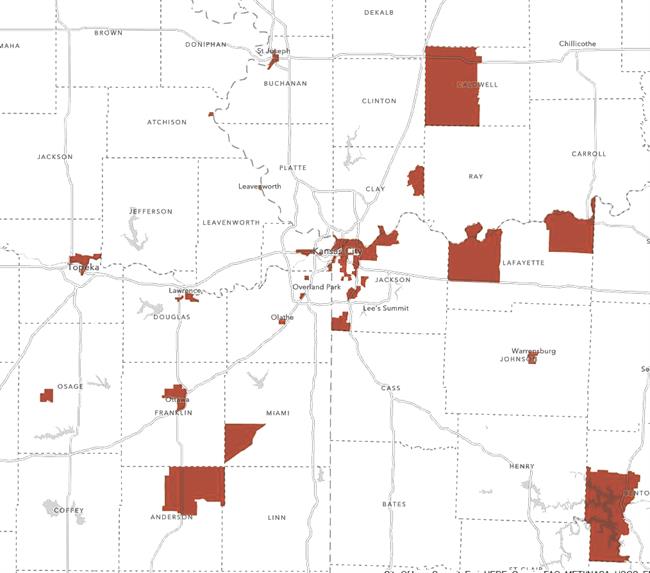

Kc Region Taxes Financial Incentives Profile Kcadc

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Does Kansas Charge An Inheritance Tax

States With An Inheritance Tax Recently Updated For 2022 Jrc Insurance Group

Assessing The Impact Of State Estate Taxes Revised 12 19 06

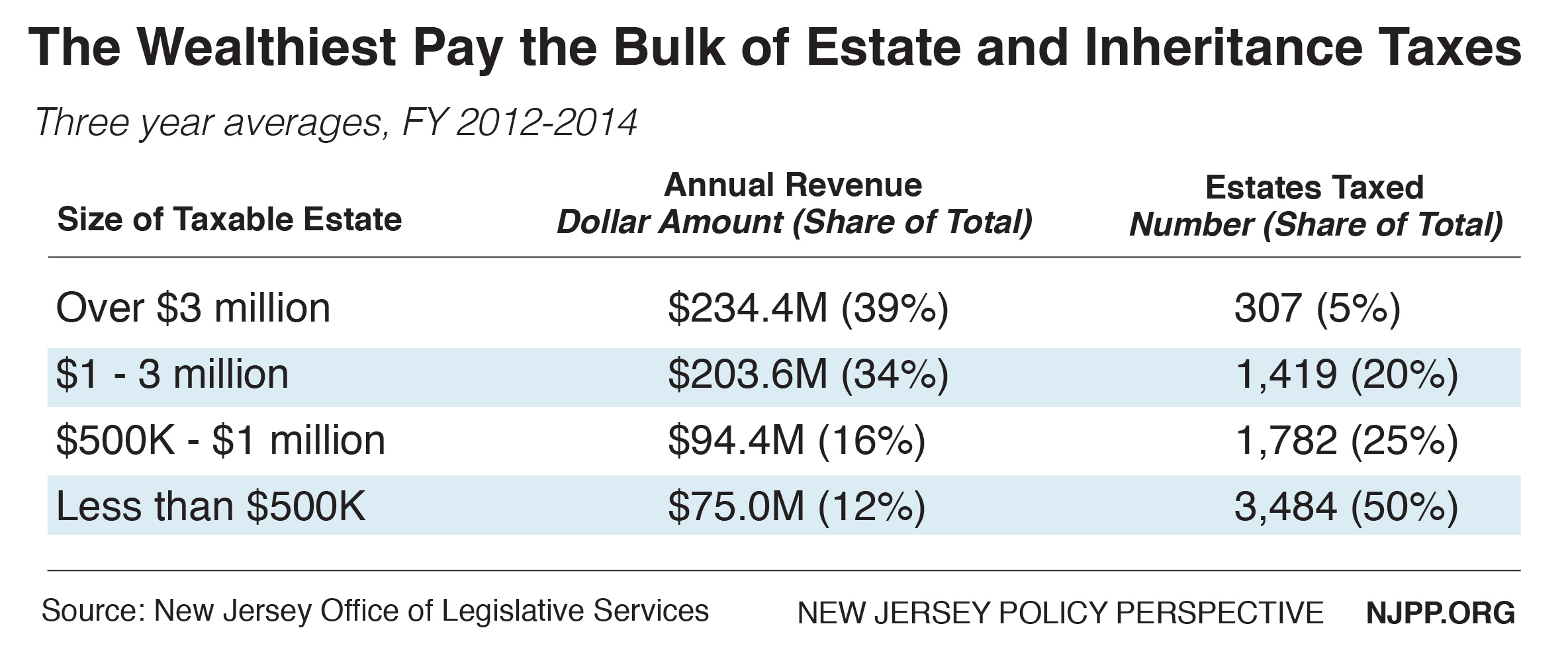

Fairly And Adequately Taxing Inherited Wealth Will Fight Inequality Provide Essential Resources For All New Jerseyans New Jersey Policy Perspective